How to Trade Forex in Olymptrade

Assets for trading Forex on Olymptrade

Each trader eventually decides on a certain type of asset, which he prefers to work with. The oil price dynamics really differs from changes in Bitcoin price, and the movement of the EUR/USD currency pair cannot be mixed up with that of the USD/TRY quotes.we will present the assets available for trading in the Forex mode of the Olymptrade platform and through the MetaTrader 4 terminal. Both projects are popular with traders, but each of them has its unique characteristics. One of the differences is the list of trading instruments.

Olymptrade Forex and MetaTrader 4

The Olymptrade broker supports two separate trading platforms—olymptrade.com itself and the popular terminal MetaTrader 4.Although the brand of both projects is the same, trading conditions (spreads, commissions, trading servers, etc.) are different. This is the reason why traders can access different assets when working on these platforms.

Asset types compared

We have prepared for you a table, which shows the basic characteristics of these products. To get the most of your trading, pay attention to the assets with high or medium volatility and a possibility to use the maximum or average multiplier.| Asset type | Volatility | Multiplier | Trading period | News impact | Platform |

| Currency pairs | High | Maximum | Monday to Friday 24 hours a day | High | Olymptrade, MetaTrader 4 |

| Metals (Commodity) | High | Medium | Monday to Friday 24 hours a day | Medium | Olymptrade, MetaTrader 4 |

| ETF | Medium | Low or none | During the US exchanges working hours | High | Olymptrade |

| Indexes | Medium | Medium | Monday to Friday 24 hours a day | Medium | MetaTrader 4 |

| Cryptocurrencies | High | Low | 24 hours a day every day | Medium | Olymptrade |

| Stocks of companies | Depends on the specific stock | Medium | During the working hours of US exchanges | High | Olymptrade |

Why choose the Olymptrade Forex platform?

First, more than 70 currency pairs and other assets with regular trends are available for trading. Best of all, traders earn money on these trends.

Second, you can select an optimal trading strategy even for small investments.

Next, the Take Profit and Stop Loss services will help you get the maximum profit and minimize losses.

The advantage of trading on the Olymptrade Forex platform is that the amount of profit from a trade is unlimited and the maximum loss cannot exceed the invested amount.

Last, Olymptrade Forex is suitable for both traders who prefer to make a large number of trades within a trading session and for those who like to close long-term trades.

How do I trade Forex?

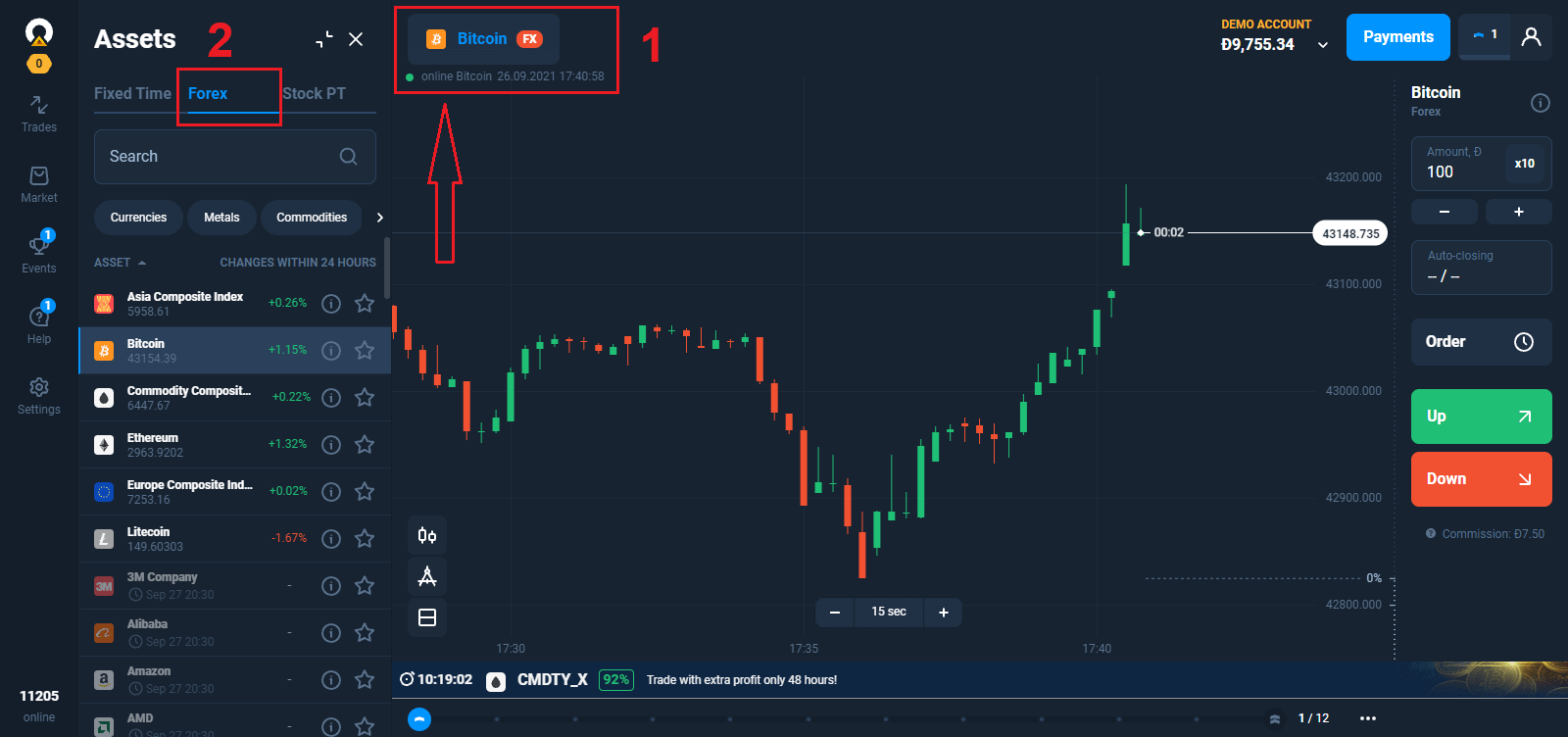

1. Choose asset for trading.

- You can scroll through the list of assets. The assets that are available to you are colored white. Click on the assest to trade on it.

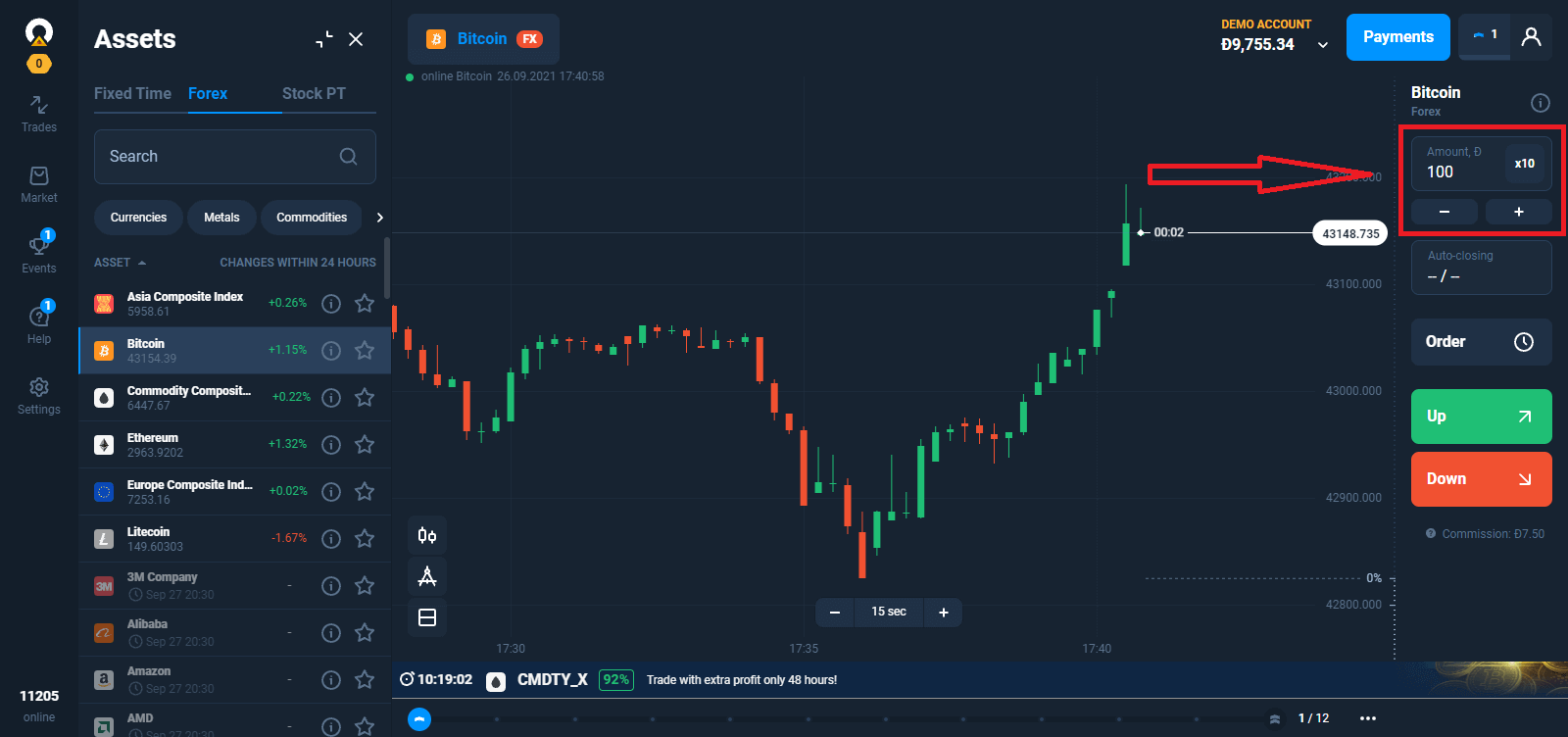

2. Indicate the trade amount.

The minimum investment amount is $1/€1.

In Forex mode, the maximum trade amount depends on your current status:

- Starter Status is $2,000/€2,000 without a multiplier and $1,000,000/€1,000,000 when taking it into account.

- Advanced Status is $3,000/€3,000 without a multiplier and $1,500,000/€1,500,000 with it.

- Expert Status is $4,000/€4,000 without a multiplier and $2,000,000/€2,000,000 with it.

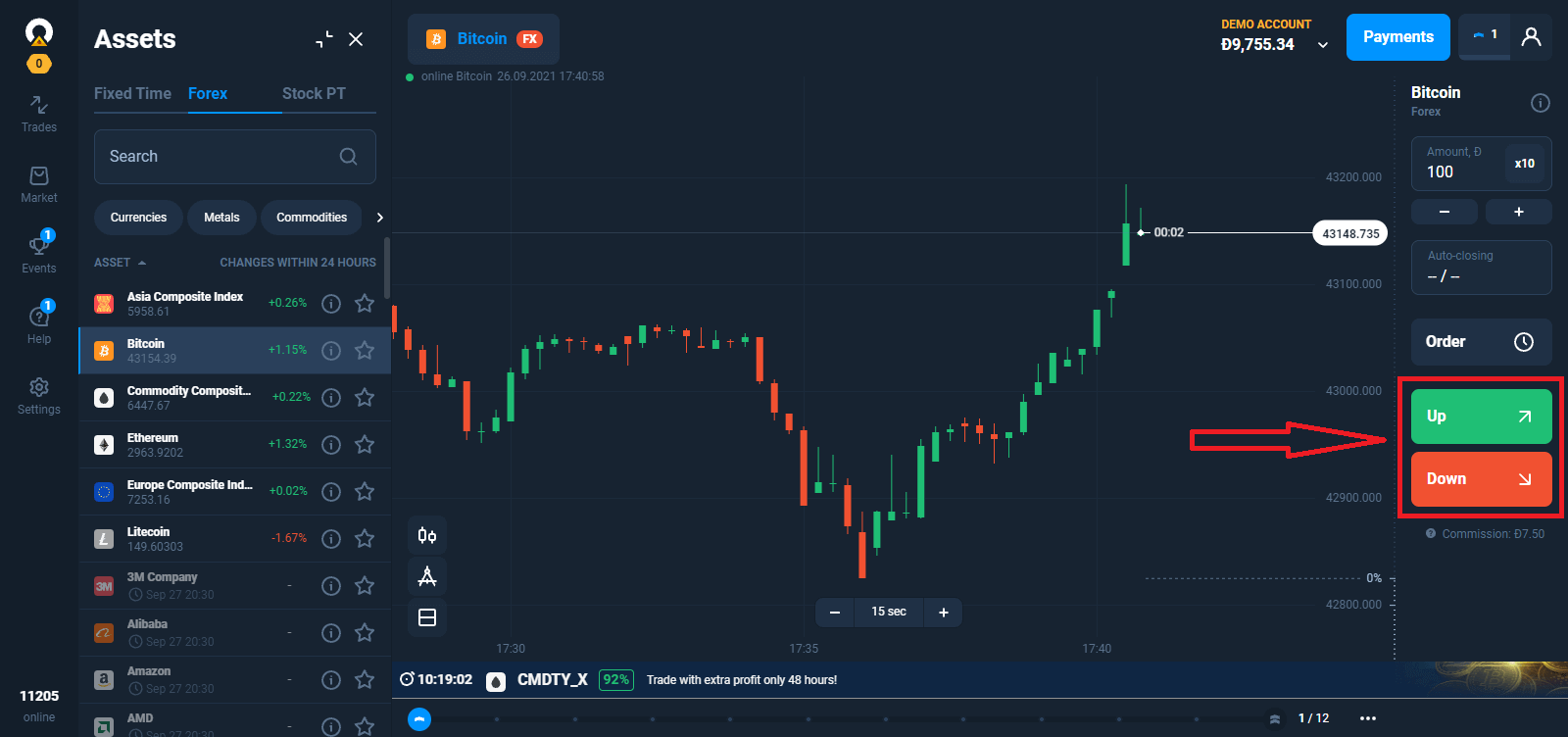

3. Analyze the asset price chart and select a direction. An Up trade makes a profit if the assets price increases. A Down trade will be profitable if the price decreases.

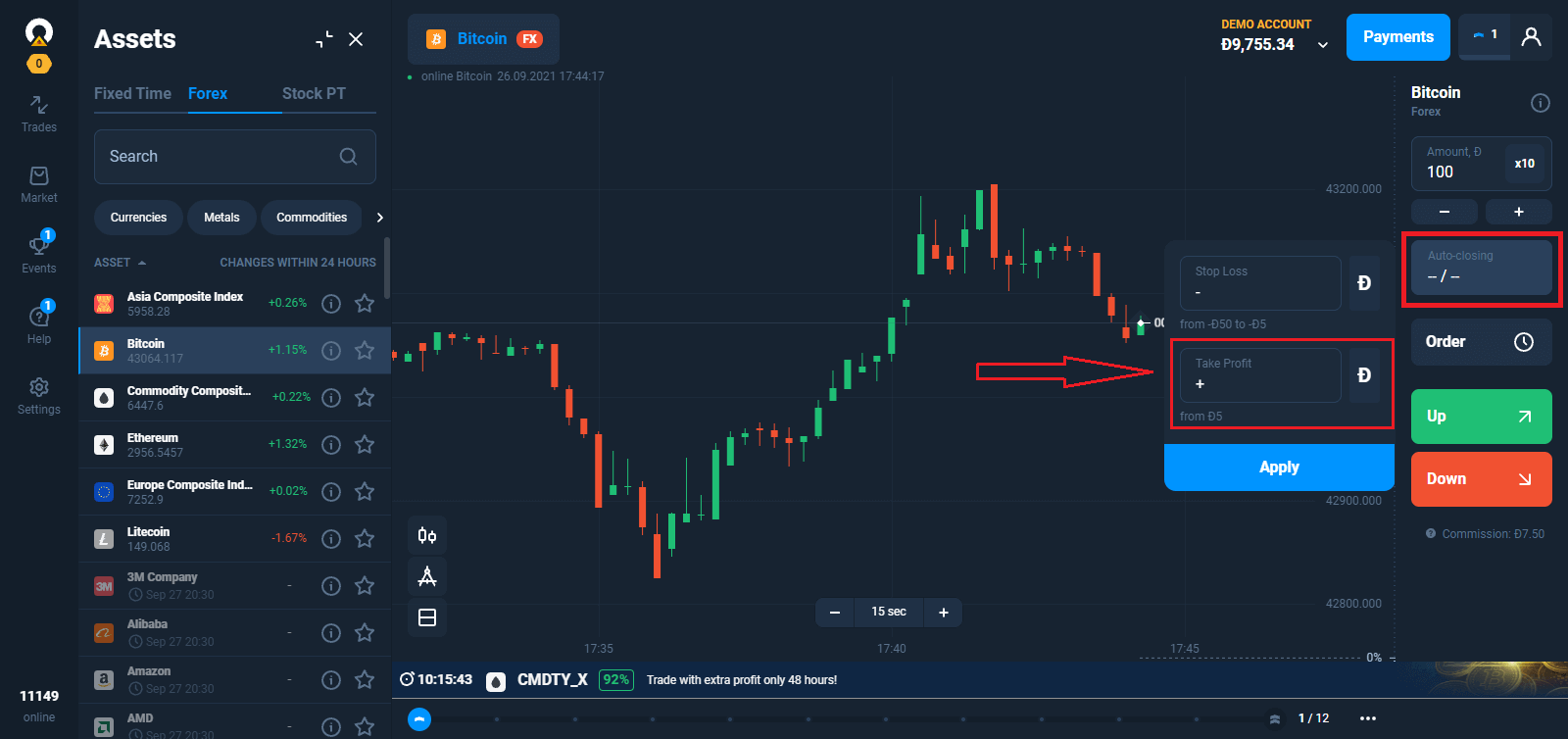

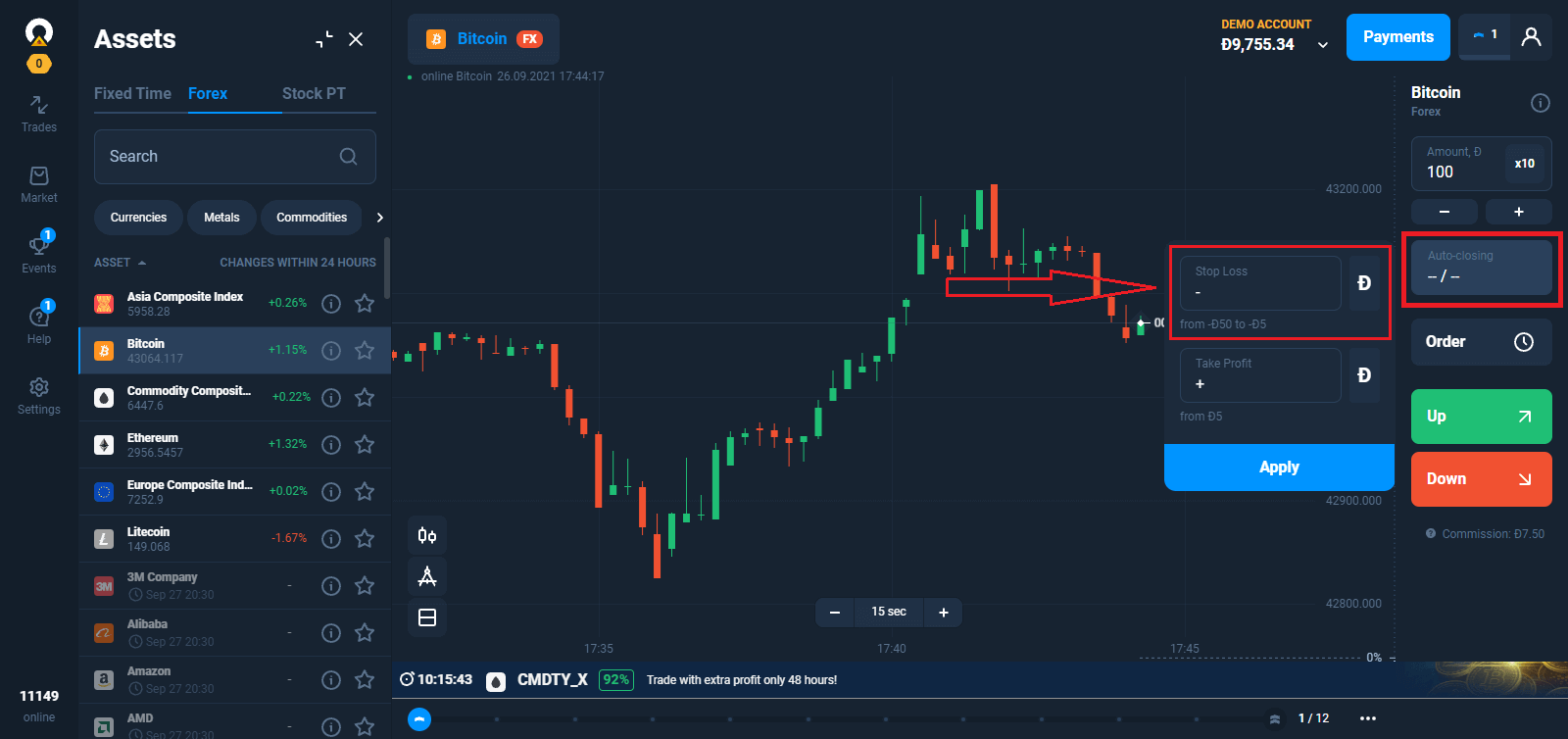

4. Auto-closing, If you want a trade to close automatically at a certain profit, enter a Take Profit parameter.

You can limit the maximum loss and automatically close a trade by indicating the Stop Loss parameter you want.

While Take Profit and Stop Loss may be amended on an open trade, both require to be set at a certain distance away from the current price level.

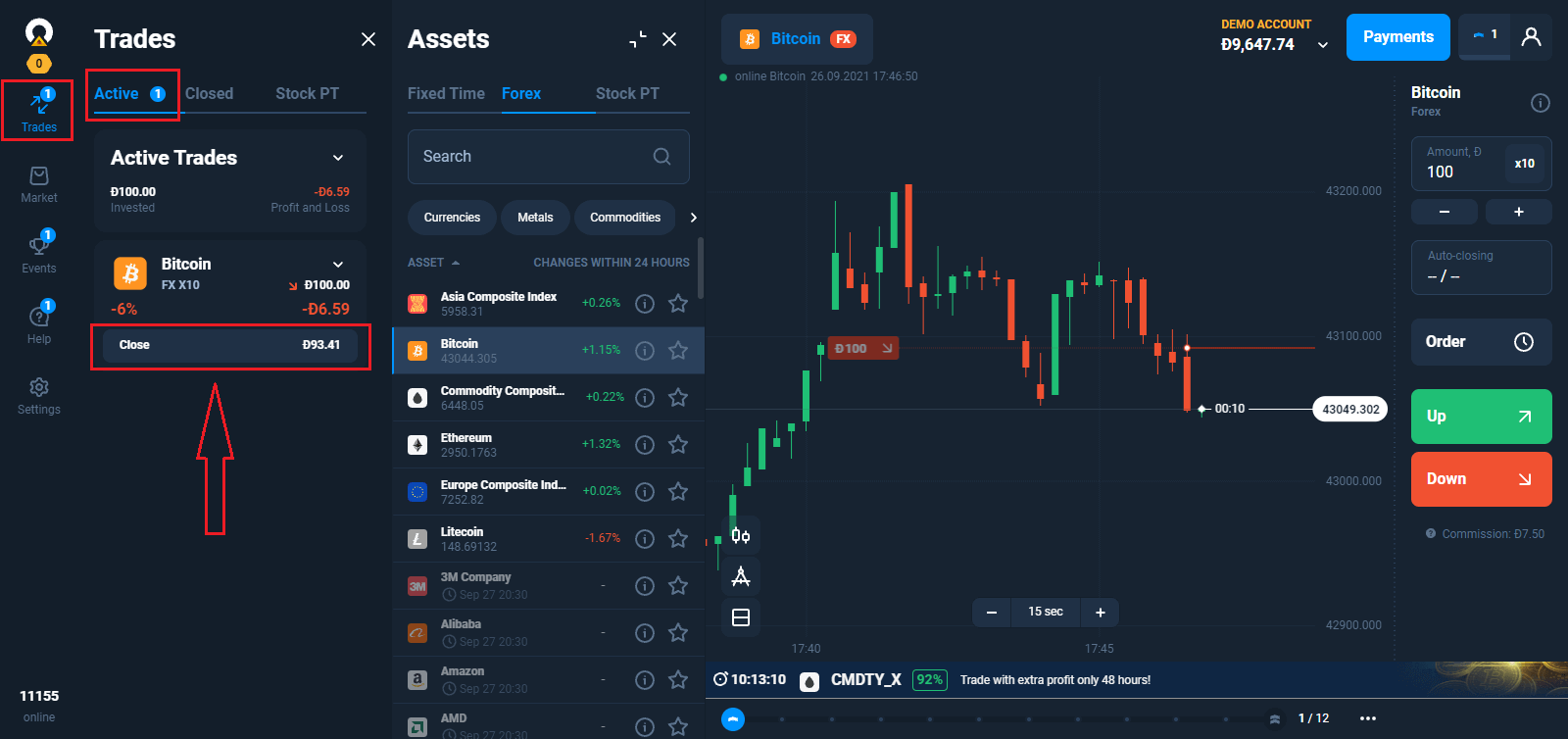

5. After opening a Trade, you can close a trade with the current result at any time.

What determines the amount of profit?

– The difference between the opening and closing price.– The value of the investment.

– The size of the multiplier.

– Commission for opening the deal.

– Commission to transfer the deal on the next day.

How to Calculate Profit

The Forex trade result consists of the difference between the opening price and the closing price of the asset. In long trading, the trader earns a profit from the price’s growth. The short trading is the opposite, with the profit earned from the lowering of the price.A simple formula will help you with that:

(Difference between the opening and closing of the trade / Current price) * Investment’s volume *Multiplier - Commission = Profit.

For example, a trader opened a long trade for USD/JPY. The opening price is 105,000. The closing price is 105,500. $100 was invested. Multiplier equals x500. Just like that, the trade volume is $50,000, with the opening commission of $4.

((105,500 - 105,000) / 105,500) * 100 * 500 - 4 = $232.9

If the multiplier is x1, then you can skip the part with multiplying by it.

How to Determine Potential Profit Quickly

Set up the multiplier and the investment. If you want to open a long trade, then point your mouse on the trade opening button “Up”. Now, pay attention to the profitability scale on the chart. It will help you to find out the amount of profit (or how much you will lose) you will receive if the asset reaches a certain price.Frequently Asked Questions (FAQ)

Trading Conditions

What is Stop Out?

A service for automatically closing a losing trade, thereby protecting the traders balance from a negative value. The Stop Out level shows the amount of investment that shouldnt be in the loss from the deal to remain active and not automatically closed.Types of Stop Out

For the most assets, Stop Out equals 0%, meaning that the deal is automatically closed when the losses reach 100% of the investment. However, there are assets (for example, stocks, cryptocurrencies, and indexes), where Stop Out is at 50%. In this case, if the trade loses 50% of the investment, the trade will be forcibly closed.You can find out the relevant information about the Stop Out level for every instrument in the Trading Conditions section.What is Trailing Stop Loss

Trailing Stop Loss (TSL) is an updated Stop Loss order with an option to automatically follow the asset’s price for a specific price range. You can get TSL as a reward for earning Experience Points on Trader’s Way.How does Trailing Stop Loss work?

The principle behind TSL is simple: should you open a long trade with Stop Loss -$10 and activated TSL, then whenever the position’s profit will increase for $10, TSL will rise as well.Similar rules apply to the quotation’s condition. If the long trade has a Stop Loss when the position drops for 100 points, then every 100 raise in the position will move TSL as well.

How to Enable Trailing Stop Loss

You can activate TSL in the «Automatic closure» menu, where Take Profit and Stop Loss parameters are edited. If you want to enable TSL for the already open trade, then you need to go to the «Trades» menu, open the tab with information, and choose Trailing Stop Loss.Why does the minimum value of a multiplier vary for different assets?

Each asset type has its own characteristics: the trading mode, the volatility. Trading conditions offered by our liquidity provider can also be different for various assets. This is why the multiplier’s minimum values vary when trading different types of assets.The minimum multiplier for trading currency pairs is x50, while it can be x1 for trading stock.

Minimum Multiplier Values for Different Asset Types

– Currency pairs — х50– Cryptocurrencies — х5

– Metals, commodities — х10

– Indices — х30

– Stock — х1

– ETF — x1

Please note that the multiplier’s value available for trading a specific asset may vary due to force majeure events.

The detailed information about the conditions for trading certain assets can be found in the “Trading Conditions” tab of the “Assets” menu.

Why does the maximum value of a multiplier vary for different assets?

The maximum value of a multiplier depends on the asset type, its peculiarities, and the conditions offered by our liquidity providers.Maximum Multiplier Values for Different Asset Types

– Currency pairs — х500– Cryptocurrencies — х10

– Metals, commodities — х50

– Indices — х100

– Stock — х20

– ETF — x5

The detailed information about the conditions for trading certain assets can be found in the “Trading Conditions” tab of the “Assets” menu.

Trade Duration in Forex Mode

Trades made on Forex are not limited in time. A position can be closed manually or automatically upon reaching the values specified when setting a Stop Out, Stop Loss, or Take Profit.Topping Up a Trade

In your trading you may come across instances when the price chart approaches the Stop Loss level, but you’d like to keep the trade open for longer, to give it a chance to go from lossmaking to profitable. In such a case, you can add money to the trade (“top up”) to postpone the Stop Loss closure.How it works:

1. Open a Forex trade with a multiplier greater than x1.

2. Set a Stop Loss level on the chart.

3. Drag the SL level towards -100%/-50% of the transaction amount (depending on the Stop Out level of that asset).

4. A confirmation dialogue will appear with the new terms for your trade. Youll be offered to increase the trade amount and lower the multiplier. The total volume of the position will stay the same.

5. Confirm the changes. The required amount will be added to the trade from your account balance. The Stop Loss will be set at a new level and the trade will remain open.

Additional information:

- Maximum level for trade top-up is limited by the amount available in the trading account. One can not add more money to a trade than what they have on the balance.

- Maximum level for topping up a trade is limited by multiplier x1. As soon as the multiplier is down to x1, you can not add any more money to the trade.

- Maximum amount of trade top-up can be more than the maximum preset transaction amount.

- There are no commissions for topping up a Forex trade.

Commissions

Commissions for Making Trades

When opening a Forex trade, a certain amount is deducted from the traders balance. This amount depends on several criteria: trade amount, multiplier, asset specification, etc. The current commission is shown along with the rest of the information about the trade. However, the final payment may sometimes differ slightly due to the market situation.Information about the minimum commission rate for opening a trade and other conditions can be found in the "Trading Conditions" tab of the "Assets" menu. You can access it through the "Help" section.